In conditions of active foreign economic activity and regular movement of goods across customs borders, correct documentation is critically important for business. One of the key tools in this area is the transit declaration T1 — a document that allows legal transportation of goods across the territory of the European Union and other countries without paying customs duties and taxes at the initial stage.

In this article, we will examine in detail what the T1 declaration is, when it is required, how to complete it, which documents accompany transit, and what consequences a company may face in case of rule violations. The material will be useful for exporters, logisticians, customs brokers, and everyone involved in international cargo transportation.

WHAT IS THE TRANSIT DECLARATION T1?

The transit declaration T1 is an official document used within foreign economic activity during the transportation of goods through the territory of the European Union (EU) and other countries participating in the common transit system. It allows goods to be moved without paying customs duties and taxes until the cargo arrives at the final destination point, where the final customs clearance takes place.

The T1 system is part of the broader Common Transit Procedure regulated by the EU Customs Code and the Convention on a Common Transit Procedure.

IN WHICH CASES IS THE T1 DECLARATION USED?

The T1 procedure is used in many logistics scenarios where goods are moved within or across the borders of the EU. Below are the most common examples when a transit declaration T1 is required:

Maritime import from non-EU countries followed by road transport within the EU.

For example, goods arrive by sea at an EU port from the USA or Japan and are then transported by road to an internal customs post for clearance or to a customs warehouse for storage or transshipment.

Maritime import with subsequent export outside the EU.

Goods arrive at a seaport of an EU member state from a non-EU country and are transported by road to the EU customs border. In this case, the T1 declaration is issued at the border customs office.

Movement between customs warehouses within the EU.

For example, goods are moved from a customs warehouse in Germany to one in Latvia. Since customs clearance has not yet been completed, T1 must be issued.

Land import to the EU.

Goods are brought through a land border from third countries into the EU and sent to a customs post for clearance or to a warehouse for temporary storage.

Land transit to a seaport outside the EU.

For example, cargo enters the EU by land but is destined for further export by sea from a port located in a non-EU country.

In all the above cases, the T1 declaration is created based on an invoice, packing list, and a power of attorney from the sender. It ensures customs control throughout the transportation route and allows avoiding immediate payment of duties until final clearance.

MAIN ADVANTAGES OF USING THE T1 DECLARATION

Here are the main reasons companies use T1:

- Deferral of customs duties and VAT payment until arrival at the final destination.

- Minimization of financial risks — the goods remain under customs control.

- Simplified movement of goods across EU borders.

- Digitization and automation of the process through the NCTS (New Computerised Transit System).

VALIDITY PERIOD AND CONTROL OF T1

The validity period of the declaration depends on the route and distance — usually from 2 to 8 days.

Control is exercised through the NCTS system data and customs stamps at control points.

Violations (delays, route changes, seal loss) can lead to fines or duty payment obligations.

WHO CAN SUBMIT A T1 DECLARATION?

T1 can be submitted by:

- Customs representatives (brokers)

- Carriers registered in the NCTS system

- Exporters/importers with an EORI number

It is important that the submitting party has financial guarantees (a guarantee certificate) — this is a mandatory requirement of customs authorities.

HOW IS THE TRANSIT DECLARATION T1 COMPLETED?

The procedure is as follows:

- Preparation of documents: Invoice, packing list, CMR, transport contract, etc.

- Availability of EORI numbers for participants

- Entering data into the NCTS system: Via a customs representative (broker) or independently

- Submission to the customs office of departure

- Customs verifies documents and assigns an MRN (Movement Reference Number)

- Sealing of the cargo: Customs seals are installed

- Transportation under customs control: Cargo moves along the route specified in T1

- Completion of the procedure at the destination customs office: Cargo is checked and final customs clearance is performed

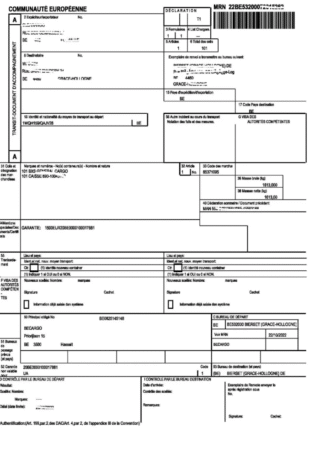

WHAT INFORMATION DOES THE T1 TRANSPORT DECLARATION CONTAIN?

The T1 declaration includes the following key information:

| Field | Description |

|---|---|

| Sender and receiver | Name, address, EORI number |

| Carrier | Responsible for delivery |

| Goods | Description, codes, quantity, weight |

| Documents | Invoices, packing lists, certificates |

| Customs codes | Procedure code, transport type, routes |

| Guarantees | Financial guarantees covering possible duties |

WHAT DOCUMENTS ACCOMPANY THE T1 DECLARATION?

The following documents accompany the T1 declaration:

- CMR — international consignment note

- Invoice

- Packing list

- TAD (Transit Accompanying Document) — printed T1 declaration with MRN barcode

- Guarantee documents — bank or insurance guarantee covering potential customs payments

These documents ensure transparency and completeness of the transit procedure. They serve as evidence of the legality of the goods, route, and compliance with all customs requirements. Without a full package of accompanying documents, customs may suspend or reject the acceptance of T1. Therefore, it is important to prepare documents carefully in advance and keep them accessible throughout the cargo route.

WHAT HAPPENS IF THE T1 DECLARATION IS NOT CLOSED?

If the T1 declaration is not properly closed:

- Customs authorities may require payment of duties and VAT from the guarantor.

- Administrative proceedings may be initiated, negatively affecting the company’s reputation.

- The company risks fines and restrictions on further cargo movements through customs checkpoints.

Failure to close T1 creates serious risks for both exporters and carriers. Therefore, it is critically important to monitor the status of the declaration, verify its closure via the NCTS system, and keep all supporting documents. In case of errors or delays, it is necessary to promptly contact customs authorities to avoid financial losses.